The quarterly update of the AAA’s EV Index shows Australians are continuing to shift towards electric vehicles and that internal combustion engines’ market share continues to decline.

The quarterly update of the AAA’s EV Index shows Australians are continuing to shift towards electric vehicles and that internal combustion engines’ (ICE) market share continues to decline.

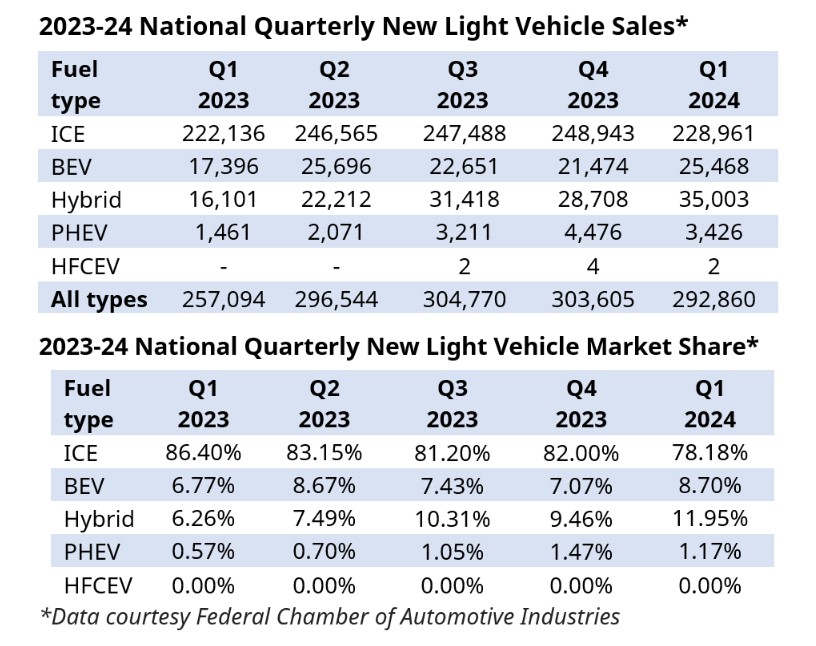

Battery electric vehicle (BEV) and hybrid new vehicle sales continue to grow. Both segments recorded record market share in the three months to 31 March.

The AAA EV Index online data dashboard, produced by Australia’s peak motoring body, analyses all new light vehicle sales across the country.

In national new light vehicle sales from Q4 2023 to Q1 2024:

From Q4 to Q1, national light vehicle sales declined by 3.54%, but year-on-year (31 March 2023 to 31 March 2024) total sales rose 13.91%.

Sales figures over the five quarters confirm a clear trend of growth for BEVs and hybrids and a gradually shrinking market share for ICEs. But there have also been significant quarterly fluctuations in the past 15 months.

Over that period, BEV market share rose from 6.77% to 8.70% and total BEV sales rose from 17,396 to 25,468. The strongest quarters for total BEV sales and markets share were Q2 2023 and Q1 2024.

In the first half of 2023 BEVs outsold hybrids, but since then hybrids have outsold BEVs in three consecutive quarters, accounting for 11.95% of all light vehicle sales (rising from 9.46% in Q4 2023 and up from 6.26% in Q1 last year). Hybrid sales volume rose by 117% in the 12 months from the end of 31 March 2023 to 31 March 2024.

ICE vehicle sales have risen year-on-year (up from 222,136 in Q1 2023 to 228,961 in Q1 2024), but over that period the ICE share of a growing market has declined by more than 8% (down from 86.40% to 78.18%). Over the last five quarters, ICE market share peaked in Q1 2023 (86.40%) and sales volume peaked in Q4 2023 (248,943).

Fuel types and vehicle types – Q1 2024

In the March quarter, ICE vehicles still dominated the small car, small SUV and large SUV market segments with hybrids a distant second.

More than 99% of utes and vans sold were ICE vehicles, as were more than 95% of people movers sold.

But only 18.61% of medium-sized cars sold were pure ICE.

BEVs accounted for 52.56% of medium car sales and 39.48% of large car sales. BEVs also performed relatively strongly in the medium SUV segment (14.77% of sales).

Hybrids sold most strongly among medium cars (28.44%), medium SUVs (21.61%), small cars (17.05%) and small SUVs (11.91%).

EV Index

The AAA EV Index provides unbiased data on Australia’s vehicle technology transition. It collates information from multiple national, state and territory sources, including information provided by the Federal Chamber of Automotive Industries, which is used with the FCAI’s permission.

The Index is intended to enable consumers, businesses, and fleet managers to see the trends transforming the national vehicle market. Its online dashboard covers light vehicles of all fuel types – BEVs, PHEVs, conventional hybrids, HFCEV, and ICE.

For more information – including state and territory sales figures – see evindex.au and the tables attached to this release.

The Federal Government must be transparent about the impacts of its proposed New Vehicle Efficiency Standard if it is to deliver lasting change that can provide long-term certainty.

read more

The Biden Administration’s significant recalibration of the USA EPA’s fuel efficiency standard means both sides of politics in Canberra must reconsider their respective approaches to setting up similar Australian regulation.

read more

Australia’s road toll continues to climb, with 1,286 road deaths in the year to 29 February – up 9.9% on the preceding 12-month period.

read more